Please click on each project to find out more.

Publications

We develop early warning models for financial crisis prediction using machine learning techniques on macrofinancial data for 17 countries over 1870–2016. Machine learning models mostly outperform logistic regression in out‑of‑sample predictions and forecasting. We identify economic drivers of our machine learning models using a novel framework based on Shapley values, uncovering non‑linear relationships between the predictors and crisis risk. Throughout, the most important predictors are credit growth and the slope of the yield curve, both domestically and globally. A flat or inverted yield curve is of most concern when nominal interest rates are low and credit growth is high.

Click here for the Staff Working Paper version of the paper and the accompanying blogpost.

We study the implications of multi-period mortgage loans for monetary policy, considering several realistic modifications — fixed interest rate contracts, lower bound constraint on newly granted loans, and possibility for the collateral constraint to become slack — to an otherwise standard DSGE model with housing and financial intermediaries. We estimate the model in its nonlinear form and argue that all these features are important to understand the evolution of mortgage debt during the recent US housing market boom and bust. We show how the nonlinearities associated with the two constraints make the transmission of monetary policy dependent on the housing cycle, with weaker effects observed when house prices are high or start falling sharply. We also find that higher average loan duration makes monetary policy less effective, and may lead to asymmetric responses to positive and negative monetary shocks.

This paper examines the effects of unconventional monetary policy measures by the European Central Bank on nine European countries not adopting the euro with a novel Bayesian mixed-frequency structural vector autoregressive technique. Unconventional monetary policy disturbances generate important domestic fluctuations. The wealth, the risk, and the portfolio rebalancing channels matter for international propagation; the credit channel does not. The responses of foreign output and inflation are independent of the exchange rate regime. International spillovers are larger in countries with more advanced financial systems and a larger share of domestic banks. A comparison with conventional monetary policy disturbances and with announcement surprises is provided.

Working Papers

We use data on monthly patent applications to construct an external instrument for identification of technology news shocks in an information-rich VAR. Technology diffuses slowly and affects total factor productivity in an S-shaped pattern. Responsible for about a tenth of economic fluctuations at business cycle frequencies, the shock elicits a slow, large and positive response of quantities, and a sluggish contraction of prices followed by an endogenous easing of the monetary stance. The ensuing economic expansion substantially anticipates any material increase in TFP. Technology news shocks are strongly priced into the stock market on impact, but measures of consumer expectations take sensibly longer to adjust, consistent with a New-Keynesian framework with nominal rigidities, and featuring informationally constrained agents.

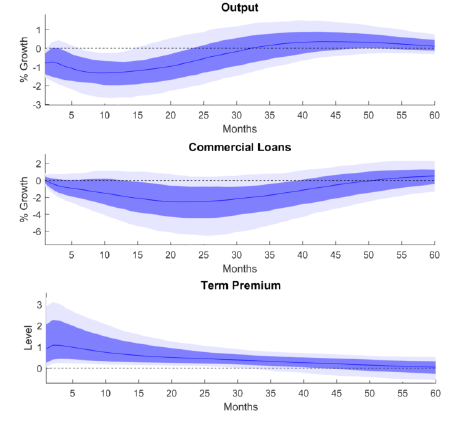

We develop a dynamic stochastic general equilibrium framework that can account for important macroeconomic and financial moments, given Epstein-Zin preferences, heterogeneous banking and third-order approximation methods that yield a time-varying term premium that feeds back to the real economy. A risk perception shock increases term premia, lowers output, and reduces short-term credit in the private sector in response to higher loan rates and constrained borrowers, as banks rebalance their portfolios. A ‘bad’ credit boom, driven by investors mispricing risk, leads to a more severe recession and is less supportive of economic growth than a ‘good’ credit boom based on fundamentals.

Click here for a preliminary version of the paper and the accompanying blogpost.

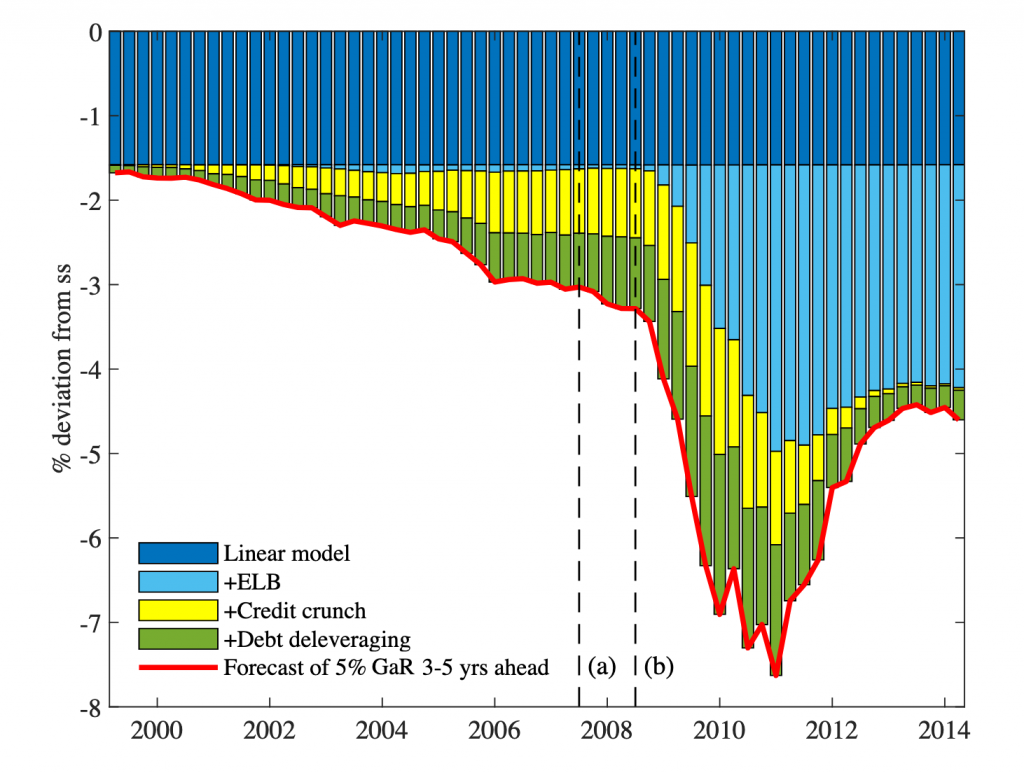

We build a semi-structural New Keynesian model to study the drivers of macroeconomic tail risk (‘GDP-at-Risk’). Our model features three key non-linearities: a lower bound on nominal interest rates; a credit crunch in bank loan supply when bank capital depletes; and deleveraging by borrowers when debt service burdens become excessive. These non-linearities can interact to amplify GDP-at-Risk: for example, when debt burdens rise sufficiently, this increases the risk of debt deleveraging but also that of a credit crunch and hitting the effective lower bound. We simulate a persistent inflation shock to analyse how these interactions might operate at this juncture.

Click here for the Working Paper and the Bank Underground blogpost.

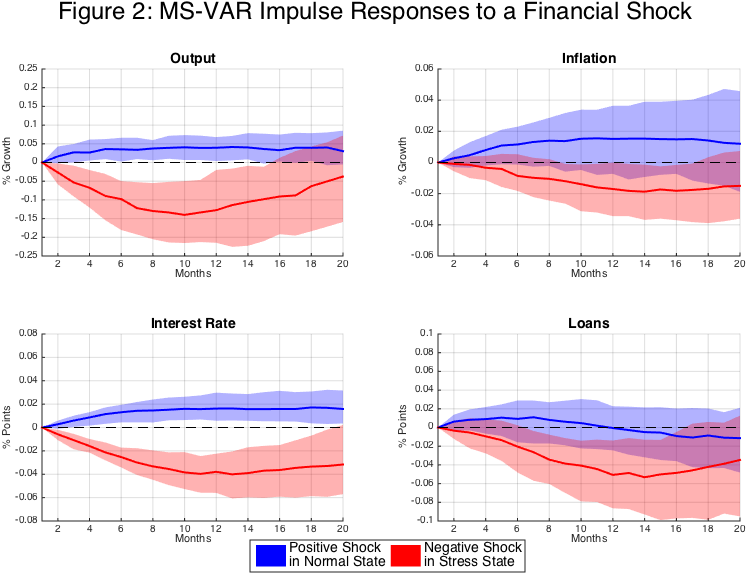

The 2008 financial crisis has shown that financial busts can influence the real economy. However, there is less evidence to suggest that the same holds for financial booms. Using a Markov-Switching vector autoregressive model and euro area data, I show that financial booms tend to be less procyclical than financial busts. To identify the sources of asymmetry, I estimate a non-linear DSGE model with a heterogeneous banking sector and an occasionally binding borrowing constraint. The model matches the key features of the data and shows that the borrowers’ balance sheet channel accounts for the asymmetry in the macro-financial linkages. The muted macro-financial transmission during financial booms can be exploited for macroprudential policies. By comparing capital buffer rules with monetary policy ‘leaning-against-the-wind’ rules, I find that countercyclical capital buffers improve welfare.

Click here for a current version of the paper.